Weatherford Tx Property Tax Rate . Noice of public hearing on tax rate. welcome to the website of the parker county appraisal district. what is the city’s property tax rate? the median property tax (also known as real estate tax) in parker county is $2,461.00 per year, based on a median home value of. Notice of 2024 tax rates. the fy23 proposed budget recommends setting the city's property tax rate at $0.4581 per $100 valuation. Within this site you will find general information about the district. the tax rates for tax year 2023 (fy24) are: The city’s current property tax rate is $0.3996 per $100 of assessed valuation. this notice concerns the 2022 property tax rates for city of weatherford. This notice provides information about two tax.

from texasscorecard.com

the median property tax (also known as real estate tax) in parker county is $2,461.00 per year, based on a median home value of. Notice of 2024 tax rates. This notice provides information about two tax. The city’s current property tax rate is $0.3996 per $100 of assessed valuation. Noice of public hearing on tax rate. Within this site you will find general information about the district. what is the city’s property tax rate? the tax rates for tax year 2023 (fy24) are: welcome to the website of the parker county appraisal district. the fy23 proposed budget recommends setting the city's property tax rate at $0.4581 per $100 valuation.

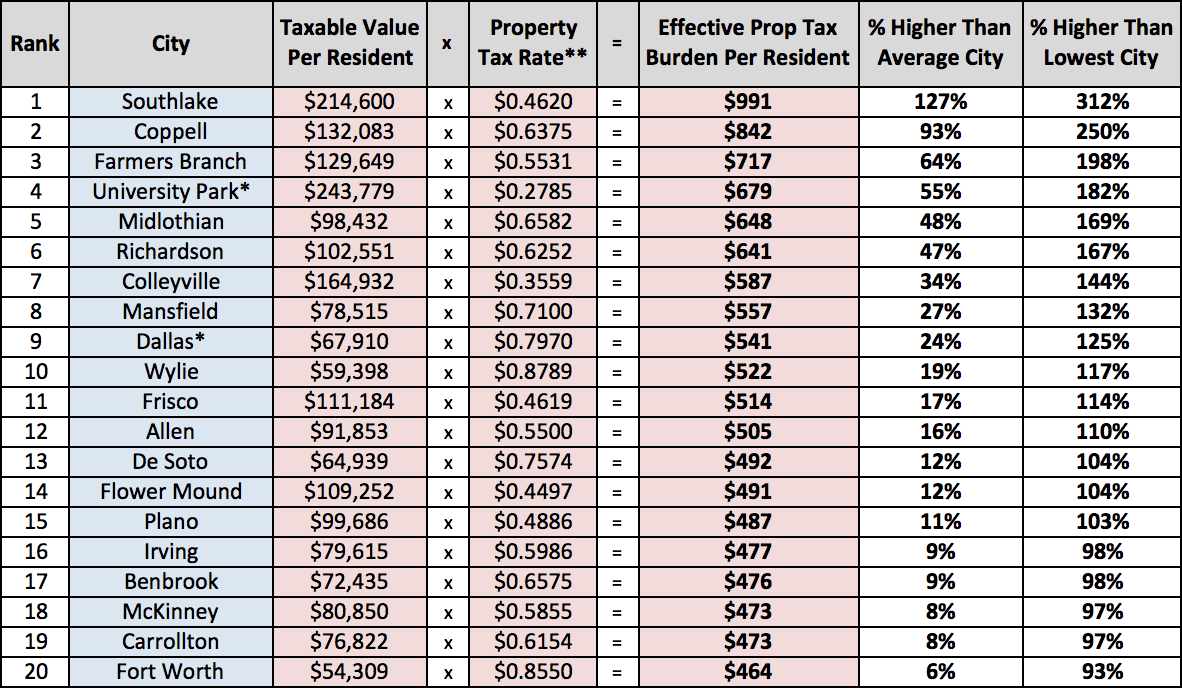

North Texas Cities Top 20 Highest Property Tax Burdens Texas Scorecard

Weatherford Tx Property Tax Rate The city’s current property tax rate is $0.3996 per $100 of assessed valuation. Within this site you will find general information about the district. the fy23 proposed budget recommends setting the city's property tax rate at $0.4581 per $100 valuation. Noice of public hearing on tax rate. Notice of 2024 tax rates. welcome to the website of the parker county appraisal district. The city’s current property tax rate is $0.3996 per $100 of assessed valuation. This notice provides information about two tax. what is the city’s property tax rate? the median property tax (also known as real estate tax) in parker county is $2,461.00 per year, based on a median home value of. this notice concerns the 2022 property tax rates for city of weatherford. the tax rates for tax year 2023 (fy24) are:

From meggibmadonna.pages.dev

Texas Tax Brackets 2024 Lucy Merrie Weatherford Tx Property Tax Rate welcome to the website of the parker county appraisal district. Within this site you will find general information about the district. this notice concerns the 2022 property tax rates for city of weatherford. the fy23 proposed budget recommends setting the city's property tax rate at $0.4581 per $100 valuation. what is the city’s property tax rate?. Weatherford Tx Property Tax Rate.

From www.financestrategists.com

Find the Best Tax Preparation Services in Weatherford, TX Weatherford Tx Property Tax Rate the tax rates for tax year 2023 (fy24) are: Notice of 2024 tax rates. the fy23 proposed budget recommends setting the city's property tax rate at $0.4581 per $100 valuation. Noice of public hearing on tax rate. The city’s current property tax rate is $0.3996 per $100 of assessed valuation. the median property tax (also known as. Weatherford Tx Property Tax Rate.

From www.city-data.com

Weatherford, TX Neighborhood Map House Prices, Occupations list of neighborhoods Weatherford Tx Property Tax Rate what is the city’s property tax rate? This notice provides information about two tax. the fy23 proposed budget recommends setting the city's property tax rate at $0.4581 per $100 valuation. the tax rates for tax year 2023 (fy24) are: Noice of public hearing on tax rate. welcome to the website of the parker county appraisal district.. Weatherford Tx Property Tax Rate.

From renatawdaisi.pages.dev

Texas Property Tax 2024 Grata Karlene Weatherford Tx Property Tax Rate Notice of 2024 tax rates. this notice concerns the 2022 property tax rates for city of weatherford. the tax rates for tax year 2023 (fy24) are: the fy23 proposed budget recommends setting the city's property tax rate at $0.4581 per $100 valuation. the median property tax (also known as real estate tax) in parker county is. Weatherford Tx Property Tax Rate.

From my-unit-property.netlify.app

Texas County Property Tax Rate Map Weatherford Tx Property Tax Rate welcome to the website of the parker county appraisal district. the tax rates for tax year 2023 (fy24) are: Within this site you will find general information about the district. this notice concerns the 2022 property tax rates for city of weatherford. Noice of public hearing on tax rate. the median property tax (also known as. Weatherford Tx Property Tax Rate.

From materialfulldioptric.z13.web.core.windows.net

Information On Property Taxes Weatherford Tx Property Tax Rate welcome to the website of the parker county appraisal district. the tax rates for tax year 2023 (fy24) are: Within this site you will find general information about the district. this notice concerns the 2022 property tax rates for city of weatherford. This notice provides information about two tax. the median property tax (also known as. Weatherford Tx Property Tax Rate.

From wallethub.com

Property Taxes by State Weatherford Tx Property Tax Rate the median property tax (also known as real estate tax) in parker county is $2,461.00 per year, based on a median home value of. the tax rates for tax year 2023 (fy24) are: This notice provides information about two tax. what is the city’s property tax rate? Within this site you will find general information about the. Weatherford Tx Property Tax Rate.

From anchorcapital.com

Understanding & Addressing an Estate Tax Liability Anchor Capital Advisors Weatherford Tx Property Tax Rate Noice of public hearing on tax rate. Within this site you will find general information about the district. the median property tax (also known as real estate tax) in parker county is $2,461.00 per year, based on a median home value of. what is the city’s property tax rate? the fy23 proposed budget recommends setting the city's. Weatherford Tx Property Tax Rate.

From exozpurop.blob.core.windows.net

Property Tax Differences Between States at Alfredo Nowak blog Weatherford Tx Property Tax Rate This notice provides information about two tax. welcome to the website of the parker county appraisal district. the tax rates for tax year 2023 (fy24) are: The city’s current property tax rate is $0.3996 per $100 of assessed valuation. the median property tax (also known as real estate tax) in parker county is $2,461.00 per year, based. Weatherford Tx Property Tax Rate.

From gertaqcatarina.pages.dev

Property Tax Ranking By State 2024 Janina Carlotta Weatherford Tx Property Tax Rate Noice of public hearing on tax rate. Notice of 2024 tax rates. the median property tax (also known as real estate tax) in parker county is $2,461.00 per year, based on a median home value of. This notice provides information about two tax. The city’s current property tax rate is $0.3996 per $100 of assessed valuation. the fy23. Weatherford Tx Property Tax Rate.

From exojvwoqx.blob.core.windows.net

Cheapest Property Tax Texas at Jonathan Miles blog Weatherford Tx Property Tax Rate the fy23 proposed budget recommends setting the city's property tax rate at $0.4581 per $100 valuation. Noice of public hearing on tax rate. Notice of 2024 tax rates. This notice provides information about two tax. this notice concerns the 2022 property tax rates for city of weatherford. what is the city’s property tax rate? the tax. Weatherford Tx Property Tax Rate.

From dxopbkaft.blob.core.windows.net

Property Taxes Spring Texas at Irons blog Weatherford Tx Property Tax Rate the tax rates for tax year 2023 (fy24) are: This notice provides information about two tax. the fy23 proposed budget recommends setting the city's property tax rate at $0.4581 per $100 valuation. Notice of 2024 tax rates. Noice of public hearing on tax rate. Within this site you will find general information about the district. welcome to. Weatherford Tx Property Tax Rate.

From www.redfin.com

2066 Sunset Rdg, Weatherford, TX 76087 MLS 20239430 Redfin Weatherford Tx Property Tax Rate The city’s current property tax rate is $0.3996 per $100 of assessed valuation. the tax rates for tax year 2023 (fy24) are: the fy23 proposed budget recommends setting the city's property tax rate at $0.4581 per $100 valuation. the median property tax (also known as real estate tax) in parker county is $2,461.00 per year, based on. Weatherford Tx Property Tax Rate.

From mungfali.com

Texas Tax Chart Printable Weatherford Tx Property Tax Rate This notice provides information about two tax. this notice concerns the 2022 property tax rates for city of weatherford. what is the city’s property tax rate? the median property tax (also known as real estate tax) in parker county is $2,461.00 per year, based on a median home value of. the fy23 proposed budget recommends setting. Weatherford Tx Property Tax Rate.

From itrfoundation.org

Property Tax Rate Limits ITR Foundation Weatherford Tx Property Tax Rate This notice provides information about two tax. the fy23 proposed budget recommends setting the city's property tax rate at $0.4581 per $100 valuation. the tax rates for tax year 2023 (fy24) are: Notice of 2024 tax rates. The city’s current property tax rate is $0.3996 per $100 of assessed valuation. Noice of public hearing on tax rate. . Weatherford Tx Property Tax Rate.

From realestatestore.me

2018 Property Taxes The Real Estate Store Weatherford Tx Property Tax Rate This notice provides information about two tax. Notice of 2024 tax rates. the fy23 proposed budget recommends setting the city's property tax rate at $0.4581 per $100 valuation. what is the city’s property tax rate? Noice of public hearing on tax rate. Within this site you will find general information about the district. welcome to the website. Weatherford Tx Property Tax Rate.

From www.xoatax.com

Texas Property Tax Key Highlights Weatherford Tx Property Tax Rate the tax rates for tax year 2023 (fy24) are: this notice concerns the 2022 property tax rates for city of weatherford. the median property tax (also known as real estate tax) in parker county is $2,461.00 per year, based on a median home value of. welcome to the website of the parker county appraisal district. . Weatherford Tx Property Tax Rate.

From www.johnlocke.org

Twentyfour Counties Due for Property Tax Reassessments This Year Weatherford Tx Property Tax Rate This notice provides information about two tax. what is the city’s property tax rate? Notice of 2024 tax rates. Within this site you will find general information about the district. welcome to the website of the parker county appraisal district. The city’s current property tax rate is $0.3996 per $100 of assessed valuation. the median property tax. Weatherford Tx Property Tax Rate.